Questions and Answers on the Contract

The value of the tentative contract is a record-setting $870 million.

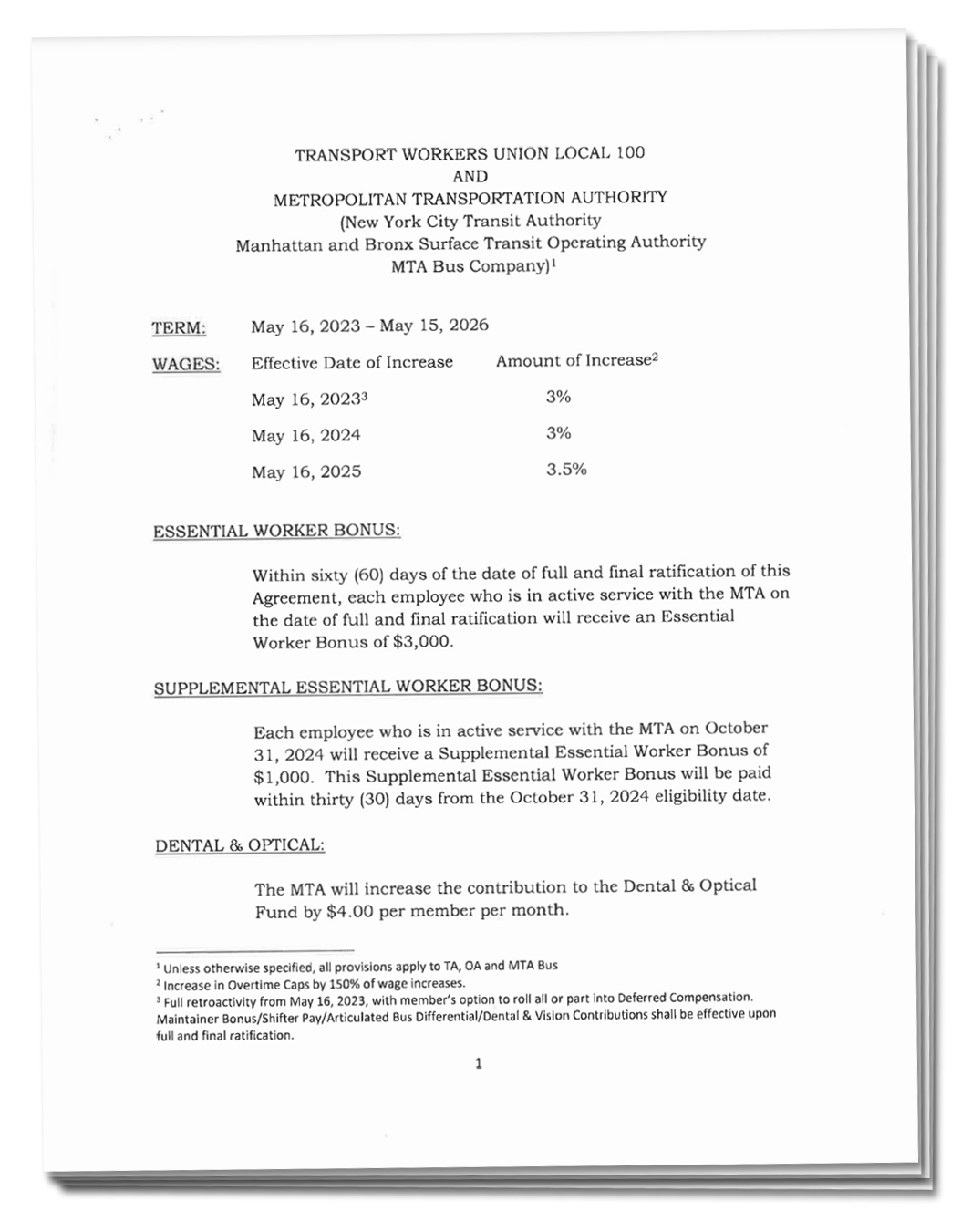

That includes compounded raises of nearly 10% - 3% retroactive to May 16, 2023; 3% next year; and 3.5% in the third year. Members also will receive two Essential Worker bonus payments totaling $4,000. This is significantly better than the city pattern.

When will we receive the Essential Worker Bonus payments?

Members will receive the first payment of $3,000 within 60 days of final ratification. The second $1,000 payment will arrive in November 2024.

Are the $4,000 in Essential Worker Bonus payments pensionable? Can I put the money into a 401k retirement plan without taxes being deducted?

Yes, and Yes. Information on how to roll the two payments will be provided after ratification.

Are the dental and vision plans improving?

Yes. The MTA will have to contribute an additional $4 per member per month of the contract to be used for dental and/or vision plan improvements. That amounts to about $2 million a year - $168,000 per month in additional revenues for dental and/or vision care. Local 100 leadership and benefit experts will identify and define the improvements after contract ratification.

What is the city pattern and why is it important?

If a union fails to negotiate a contract, or members vote down a contract, the dispute goes to an arbitration panel to decide – and then impose – the terms. Arbitrators give great weight to municipal union contracts (the so-called municipal “pattern”) when deciding Local 100/MTA contract disputes. There is a record of this happening.

The city contract with DC-37, the biggest municipal union, has 3%, 3%, and 3.25 in raises. But the last raise in this pattern is for an 18-month period. That “annual raise,” therefore, is equivalent to a 2.1% annual increase.

Our tentative contract is 3%, 3%, 3.5% over 36 months. No zeroes. The $3,000 ratification bonus DC-37 members are receiving is 30% lower than our $4,000 Essential Worker bonuses.

An arbitration panel could impose lower wage increases, smaller bonus payments, and give the MTA some of the demands it made but failed to win during negotiations.

What were the MTA demands?

The MTA wanted us to pay for our raises and benefits through givebacks. Their demands – which were defeated – included: doubling healthcare paycheck deductions from 2% to 4%; calculating overtime after 40 hours, instead of 8; running subway trains without Conductors, reducing the vacation schedule for new hires; reducing night differential pay and hours; and reducing the number of paid sick days granted at the beginning of a calendar year.

What is gainsharing and how does it work?

Gainsharing will enable Local 100 to obtain millions of additional dollars from the MTA that will be used for union-selected initiatives benefiting members. These could include improving the cash sick out, providing members bonus payments, and expanding training and educational opportunities.

There are 261 workdays a year. On average, transit workers now work 196 days. Once worker availability (average attendance) reaches 201 days, the union and management will split the savings for each additional day of worker availability that is achieved on a 50%/50% basis. That’s additional money each day for the union to direct towards member benefits. We secured a new – and achievable – way to put more money in your pocket.

What’s happening with retiree medical?

If you retire between the ages of 55 and 65, you continue with the same health care as if you were still working. No change. The same high-level of coverage continues. This is a major contractual benefit Local 100 secured years ago.

We are improving coverage – significantly – for Medicare Eligible retirees ages 65 and up, and disabled retirees. We successfully demanded that millions of dollars in federal funds go to TWU Enhanced Retiree Medical Coverage. Retirees can keep using the same doctors as now, and coverage is good in all 50 states, Washington DC, and Puerto Rico.

There are two Aetna Options, including a greatly improved zero-copay Option 1. Both are regulated and subsidized by the federal Centers for Medicare and Medicaid. The CPPO plan, which is not eligible for federal subsidies, is being discontinued.