Retirees Benefits

TWU Local 100 Enhanced

Medicare Advantage Plans

Securing Your Benefits for Life

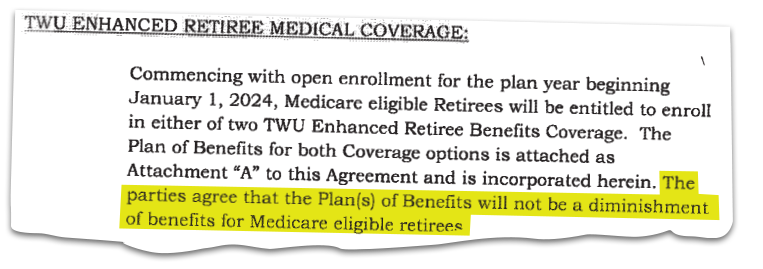

Key Features• No Diminishment of Benefits: Your healthcare benefits are contractually guaranteed and will never be reduced.

• Bridge Benefits: Continuous coverage for pre-Medicare retirees until Medicare eligibility at age 65.

Plan Options |

|

| Option 1: Zero Co-Pay Plan | Option 2: Modest Co-Pay Plan |

| ✓ No co-pays for primary care, specialists, hospitalizations, preventative care, and generic prescriptions. | ✓ Modest co-pays for medical services while maintaining comprehensive coverage. |

| ✓ $0 co-pay for emergency room visits (reduced from $100). | ✓ Full reimbursement of Medicare Part B premiums: $1,978.80 per person annually (nearly $4,000 for a couple). |

| ✓ Medicare Part B Reimbursement: $500 per retiree and $500 for Medicare-eligible spouses ($1,000 total). | |

How Do Our Two Options Compare?

See the chart below for a detailed breakdown of the TWU Enhanced Retiree Medical Coverage plans available to you.

Both options are less expensive across the board.

A comparison is below:

| TWU Option 1 | TWU Option 2 | |

| Annual Deductible | Zero | Zero |

| Annual Maximum Out-of-Pocket | Zero | $1,000 |

| Doctors: Primary/ Specialist | Zero | Zero / $5 |

| Tests/Imaging | Zero | Zero |

| Urgent Care | Zero | $50 |

| Emergency Room | Zero | $50 |

| Hospitalization | Zero | Zero |

| Part D Prescription Premium | Zero | Zero |

| Medicare Part B Reimbursement | $500+ per person ($1,000+ for a couple) | Full reimbursement ($1,978.80+ per person, $3,957.60+ for a couple) |

| Drug copays / coinsurance (30 day) | • Zero for all generics • $2.50 for Tier 2 drugs • Tier 3 drugs 25% coinsurance • Drug costs capped at $95 per drug per month |

• Generics $5 • Tier 2 drugs $10 • Tier 3 drugs $45 |

Bridge BenefitsMembers retiring before age 65 will continue to have comprehensive healthcare coverage through Bridge Benefits, ensuring uninterrupted care until Medicare eligibility. Enrollment Information• Open Enrollment Period: Medicare-eligible retirees can select between the Zero Co-Pay Plan and the Modest Co-Pay Plan. Frequently Asked QuestionsWill I be able to use the same doctors? If I change my mind, can I switch plans? What about prescriptions? Learn MoreView Contract Language on Protections (See page 4) |